| | H. Eugene Lockhart

Mr. Lockhart has served on our board of directors since December 2006. He is the Chairman of the Audit Committee, and also serves on the Compensation Committee.

Professional Experience In November 2013,2012, Mr. Lockhart became Senior Advisor North America, at General Atlantic LLC, a leading global growth investment firm. In October 2013,2014, he founded and became chairmanChairman and Managing Partner of MissionOG LLC, a growth stage investment firm. From 2002 until 2012, Mr. Lockhart was a venture partner at Oak Investment Partners, a venture capital firm. His prior positions include president of Global Retail Bank at Bank of America, as well as president and chief executive officer of MasterCard International. Through these investment firms, Mr. Lockhart has been actively involved in overseeing the management of high growth private companies, including NetSpend, Argus Information, Metro Bank PLC, CLIP, DemystData, Factor Trust, Avant, BillDesk, and others. Board Service Mr. Lockhart was appointed to the board of Metro Bank PLC, a public retail bank operating in the U.K., in March 2011, where he presently serves as the Chair of the risk and audit committee. He had served on the board of Aaron’s, Inc., alease-to-own retailer of furnishings, consumer electronics and home appliances, infrom August 2014.2014 until May 2016. He previously served as a director and audit committee chairman of RadioShack Corporation, a retail seller of consumer electronic goods and services, until March 2015. Mr. Lockhart served on the board of directors of Bonds.com, a trading platform for fixed income securities, from February 2011 until September 2013. He had served on the board of Asset Acceptance Capital Corp., a purchaser of accounts receivable portfolios, from consumer credit originators, until its June 2013 merger with Encore Capital Group, Inc., and also served on the board of IMS Health Incorporated, a global provider of information solutions to the pharmaceutical and healthcare industries, until February 2010. Mr. Lockhart has served on numerous philanthropic boards, including serving in the past as the Chair of the Thomas Jefferson Foundation (Monticello) and the Chairman of the Darden School Foundation at the University of Virginia. He is currently serving as the Chairman of Academic Affairs for the State Council of Higher Education of Virginia (SCHEV). Education Mr. Lockhart received a B.S. in Mechanical Engineering from the University of Virginia and an MBA from The Darden Graduate School of Business at the University of Virginia. In addition, Mr. Lockhart is a CPA, licensed in the Commonwealth of Virginia. Individual Contributions Mr. Lockhart brings to Huron’s board his broadconsiderable experience overseeing and growing companies in which he represents venture capital investors, his experience as chief executive officer of leading corporations, and his service on the boards of companies and foundations in a variety ofsuch fields that includeas healthcare, education, pharmaceuticals, and financial services, healthcare and pharmaceuticals.services. In addition, as a former executive and chairman of some of the world’s most recognizedvisible companies in the world, Mr. Lockhart contributes to Huron his many contacts, including those with investors.a broad array of contacts. | | |  |  | | George E. Massaro Director since May 2004 Noaminating and Corporate Governance Committee (Member) |

Professional Experience Mr. Massaro resumed the position ofhas served as Vice Chairman of Huron’s board insince May 2010, a role heand had previously served in the role from March 2005 until July 2009, when2009. In the interim, he was appointed had served asNon-executive Chairman of Huron in order to assist the new management team upon the departureduring a period of our former chairman. Mr. Massaro served as Non-executive Chairman of Huron’s board from July 2009 until May 2010. He has served as a director since May 2004.transition. Mr. Massaro joined the Company in August 2002 as a managing director, served as our Chief Operating Officer from June 2003 until March 2005, and endedceased his employment with Huron in February 2009. He serves on the Nominating and Corporate Governance Committee. Professional Experience

Prior to joining Huron, Mr. Massaro served as the managing partner of Arthur Andersen LLP’s1,200-person New England practice from 1998 to 2002 and managing partner of the Boston office from 1995 to 1998. Mr. Massaro has served clients in the financial services and high-technology industries. Board Service Mr. Massaro serveshas served as a director of Charles River Laboratories, a public provider of research products and preclinical services for the biomedical community, since 2003, and currently serves as chairman of the audit committee. Mr. Massaro had served as a member of the board of trustees of Mount Auburn Hospital in Cambridge until December 2017. He had served as a member of the finance committee of the Archdiocese of Boston until December 2017. Mr. Massaro had also served on the board of directors of Eastern Bank Corporation, an independent mutual bank holding company in New England. He is also a member of the board of trustees of Mount Auburn Hospital in Cambridge. In addition, Mr. Massaro is a member of the finance committee of the Archdiocese of Boston. England, from February 2003 until December 2017. Education Mr. Massaro received a B.A. in Accounting and Finance from Bentley College and an MBA from Babson College. Individual Contributions AsMr. Massaro contributes to the formerHuron board his unique understanding of our business and history, gained not only through his prior service as our Chief Operating Officer of Huron from 2003 to 2005, but also through his leadership of a Huron practice. Mr. Massaro possesses a distinctive understanding of Huron’s business and history. HisMassaro’s many years of experience in public accounting, and management of a professional services practice, as well as hisand service on the boards of healthcare and pharma-centered institutions, enablehave enabled him to provide a broad range ofinvaluable business insights as well asalong with contacts in the business community.

EXECUTIVE OFFICERS The Company’s executive officers are as follows: | | | | | | | | Name | | Age | | | Position | James H. Roth | | | 60 | | | Chief Executive Officer, President and Director | C. Mark Hussey | | | 57 | | | Executive Vice President and Chief Operating Officer | John D. Kelly | | | 42 | | | Executive Vice President, Chief Financial Officer and Treasurer | Diane E. Ratekin | | | 61 | | | Executive Vice President, General Counsel and Corporate Secretary |

James H. Roth’s biographical information is provided above under the caption “Directors Not Standing for Election.” | | |  | | John S. Moody

Mr. MoodyC. Mark Husseywas appointed Chief Operating Officer of Huron in February 2014. He has served on our board of directorsas Executive Vice President since November 2005.July 2011. He had served as Chief Financial Officer from July 2011 until January 2017. From that dateJuly 2011 until February 2016, he served as Chairman of the Compensation Committee, on which he continuesHuron’s Treasurer. Prior to serve. He also serves on the Audit Committee.

Professional Experience

Since January 2014,joining Huron, from 2002 to 2011, Mr. Moody has been chief executive officer of Parkside Capital, formerly known as ProTerra Realty, a fund manager investing in real estate in Houston, Texas. He had previouslyHussey served as president of Parkside Capital since January 2007. From 2004chief financial officer at Crosscom National, LLC, a privately held professional IT services organization deploying and servicingin-store technology solutions for large, national retailers. In that role, he was responsible for all finance and administrative functions for the company. Prior to that, from 2000 until October 2005, Mr. Moody2002, he served as executive vice president and chief executivefinancial officer, of HRO Asset Management, LLC, a real estate advisory business. From 2001 to 2004,North America, at Information Resources, Inc. During his career, Mr. Moody servedHussey has held senior finance, accounting and investor relations positions at entities such as president of Marsh & McLennan Real Estate Advisors,EZLinks Golf, Inc., a business that directed the execution of real estate projects and transactions for Marsh & McLennan. From 1995 to 2000, Mr. Moody was president and chief executive officer of Cornerstone Properties,Dominick’s Finer Foods, Inc., and the Quaker Oats Company. Mr. Hussey received a REIT that acquired, developedB.S. in Accountancy from the University of Illinois, Urbana-Champaign and operated large-scale Class A office buildingsan MBA in major markets throughoutFinance from the United StatesUniversity of Chicago Graduate School of Business. He is a Chartered Financial Analyst, Certified Management Accountant, and that merged into Equity Office Properties Trust.Certified Public Accountant (Illinois).

Board Service

In November 2015, Mr. Moody John D. Kellywas appointed chairmanExecutive Vice President and Chief Financial Officer of the board of Four Corners Property Trust, Inc., a public real estate investment trust, where he also serves as chairman of the compensation committee. Mr. Moody joined the board of Hines Global REIT, a privately owned real estate investment, development and management company, in June 2009. He joined the board of directors of Potlatch Corp., a real estate investment trust, in September 2006, andHuron in January 2009, he assumed the role of vice chairman of Potlatch Corp. From 2001 to 2005, Mr. Moody served on the boards of directors of three publicly held REITs: Keystone Property Trust, CRIIMI MAE, Inc. and Equity Office Properties Trust.

Education

Mr. Moody received a B.A. in History from Stanford University and a J.D. with honors from The University of Texas School of Law.

Individual Contributions

Mr. Moody has spent the majority of his career working with real estate related businesses.2017. He has served on multiple boardsas Huron’s Treasurer since February 2016. He had served as Chief Accounting Officer of directors, includingHuron from February 2015 until January 2017, and had served as Corporate Vice President from November 2012 until his appointment as Executive Vice President. Previously, Mr. Kelly had served as Controller of Huron from November 2012 until February 2015, and prior to that served as Assistant Controller from October 2009. Mr. Kelly served as Huron’s Assistant Treasurer from February 2015 until February 2016. Prior to joining Huron’s Finance and Accounting department, Mr. Kelly was a Director in the Company’s Disputes and Investigations practice for three years, serving as chairmanclients in the manufacturing and vice chairman, of companies organized as real estate investment trusts engagedservices industries. Before he joined the Company in commercial real estate, as wellDecember 2006, Mr. Kelly had held several positions within Deloitte & Touche’s Assurance and Advisory Services group, most recently as a company offering diversified forest products. AsSenior Manager. He received both a B.S. and M.S. in Accounting from the former chief executive officerUniversity of Notre Dame. Mr. Kelly is a public company which owned Class A office buildings throughout the United States, as well as a professionally trained real estate and corporate attorney with broad experience in the capital markets, Mr. Moody has provided introductions to his many business contacts.

|

Certified Public Accountant (Illinois). | | |  | | Debra Zumwalt

Ms. Zumwalt Diane E. Ratekinwas elected to Huron’s board of directors in October 2014. She is the Chair of the Compensation Committee, and also serves on the Nominating and Corporate Governance Committee.

Professional Experience

Since 2001, Ms. Zumwalt has been theappointed Vice President and General Counsel of Stanford UniversityHuron in February 2011, and iswas named Executive Vice President in chargeApril 2011. She was appointed Corporate Secretary in December 2011. She had previously served as Huron’s Assistant Corporate Secretary since May 2009. Ms. Ratekin has been employed in Huron’s legal department since January 2005, and previously served as Deputy General Counsel. Prior to joining Huron, Ms. Ratekin was a partner in the Corporate Department of McGuireWoods LLP. Previously, she spent 17 years in the legal department of Deutsche Investment Management Americas Inc., formerly known as Zurich Scudder Investments, Inc. and Kemper Financial Services, Inc., where she was a Director and Team Leader of the legal services provided to the UniversityCorporate and its two affiliated hospitals with combined annual revenues of over $9 billion.Investments Team. Before that, Ms. ZumwaltRatekin was a litigator at Jenner & Block. She is a member of the University CabinetAmerican Bar Association and provides governance, legal and strategic advicethe Chicago Bar Association. In July 2017, Ms. Ratekin was appointed to the boards of the University, Stanford Health Care, Lucile Packard Children’s Hospital at Stanford and Stanford Management Company, which manages over $24 billion in assets. Ms. Zumwalt is also a member of theMetropolitan Chicago Board of Overseers for SLAC National Accelerator Laboratory at Stanford, and a director of SUMIT Holding International, LLC and SUMIT Insurance Company Ltd., a holding company and captive insurance company providing insurance coverage for the Stanford hospitals and physicians. From 1993 to 2001, Ms. Zumwalt was a partner at Pillsbury Winthrop LLP, where she specialized in complex civil litigation and higher education law, and for whom she served as managing partner of the Silicon Valley office and a member of the firm’s governing board. Previously, from 1987 to 1993, Ms. Zumwalt was Senior University Counsel at Stanford, responsible for advising and representing the University in connection with congressional hearings, criminal and civil investigations, negotiations and litigation matters. Prior to joining Stanford in 1987, Ms. Zumwalt worked as litigation counsel for Chevron Chemical Company and as a litigation associate for Pillsbury Winthrop LLP in San Francisco.

Board Service

Ms. Zumwalt is currently a director of Exponent, Inc., an engineering and scientific consulting company. She is also on the boardDirectors of the American University of Afghanistan and the Academy of Art University and has served on other nonprofit boards in education and legal services.

Education

Ms. ZumwaltHeart Association. She received a B.S.B.A. in Political Science from Arizona State UniversityEnglish and a J.D. from Stanford Law School.the University of Iowa.

DIRECTOR INDEPENDENCE Individual Contributions

As a practicing attorneyOur Corporate Governance Guidelines require that the board of directors make an annual determination regarding the independence of each of our directors. The board of directors has determined that each of Messrs. Edwards, Lockhart, Massaro, McCartney and in-house counsel to a university with two affiliated hospitals,Moody and Ms. Zumwalt is able“independent” as defined in the applicable listing standards of The NASDAQ Stock Market, Inc. (“NASDAQ”). In making its determination, the board of directors considered the standards of independence set forth in the NASDAQ Corporate Governance

Listing Standards and all relevant facts and circumstances to shareascertain whether there was any relationship between a director and the Company that, in the opinion of the board of directors, would interfere with the Huron board a depthexercise of experience negotiatingindependent judgment in carrying out the challenges faced by both higher education and healthcare organizations. Through her former serviceresponsibilities of the director or any material relationship with the Company (either directly, or as a court appointed arbitratorpartner, stockholder or officer of an organization that has a relationship with the Company). In determining that Ms. Zumwalt is independent, the board of directors conducted a thorough review of payments made by Stanford University, which employs Ms. Zumwalt, to the Company for consulting services provided by the Company. After taking into consideration that Stanford University engagements comprised 0.12% of Huron’s revenues for the year 2017, 0.60% for the year 2016, and bar association president,0.25% for the year 2015, the board of directors determined that this relationship would not interfere with Ms. Zumwalt’s exercise of independent judgment in carrying out her responsibilities as wella director. BOARD COMPOSITION, LEADERSHIP STRUCTUREAND RISK OVERSIGHT BOARD COMPOSITION The Nominating and Corporate Governance Committee, in conjunction with the Chair and the full board, is actively evaluating the future composition of the board in light of the age, tenure and experience of its current members. This multi-year refresh process is intended to ensure that the board has the best mix of knowledge, skills and business acumen, derived from high quality professional experience, to evaluate and support the Company’s strategy going forward. The Nominating and Corporate Governance Committee believes that its current directors, several of whom have extensive experience leading and managing professional service businesses, provide significant insight into the Company and its operations and provide valuable contributions to the board. The Committee also recognizes the potential benefits of the fresh perspectives that highly qualified new directors might bring to the board. The Nominating and Corporate Governance Committee will consider a variety of factors as her current rolesit works to enhance the composition of the board, increase diversity, reduce average tenure and ensure structured and orderly board succession through a process of both board member additions and retirements. As a result, during the next several years, the board may occasionally expand or contract as the refresh process is executed. It is the expressed desire of the board that it continue to remain relatively small in number and composed principally ofnon-executive directors. The Nominating and Corporate Governance Committee will consider as director on corporatecandidates qualified individuals recommended by stockholders through the process described below and, academic boards, Ms. Zumwalt contributes a unique perspective onalthough it has not done so in the lawpast, may consider candidates identified by professional search firms. BOARD LEADERSHIP Huron formally separated the roles of chairman of the board and governance. |

Executive Officers

The Company’s executive officers are as follows:

| | | | | | | Name

| | Age | | | Position

| James H. Roth

| | | 58 | | | chief executive officer in 2010. OurNon-executive Chairman is John McCartney and our Chief Executive Officer Presidentis James H. Roth. AsNon-executive Chairman, Mr. McCartney, in consultation with Mr. Roth, develops the agendas for board meetings, determines the appropriate scheduling for board meetings, assesses the quality, quantity and Director | C. Mark Hussey

| | | 55 | | | Executive Vice President, Chief Operating Officer and Chief Financial Officer | Diane E. Ratekin

| | | 59 | | | Executive Vice President, General Counseltimeliness of information provided from management to the board, assists the Nominating and Corporate Secretary |

James H. Roth’s biographical information is provided above under the caption “Nominees to Board of Directors.”

C. Mark Hussey was appointed Chief Operating Officer in February 2014. He has also served as Executive Vice President and Chief Financial Officer since July 2011. From that time until February 2016, he served as Huron’s Treasurer. Prior to joining Huron, from 2002 to 2011, Mr. Hussey served as chief financial officer at Crosscom National, LLC, a privately held professional IT services organization deploying and servicing in-store technology solutions for large, national retailers. In that role, he was responsible for all finance and administrative functions for the company. Prior to that, from 2000 until 2002, he served as executive vice president and chief financial officer, North America, at Information Resources, Inc. During his career, Mr. Hussey has held senior finance, accounting and investor relations positions at entities such as EZLinks Golf, Inc., Dominick’s Finer Foods, Inc., and the Quaker Oats Company. Mr. Hussey received a B.S. in Accountancy from the University of Illinois, Urbana-Champaign and an MBA in Finance from the University of Chicago Graduate School of Business. He is a Chartered Financial Analyst, Certified Management Accountant, and Certified Public Accountant (Illinois).

Diane E. Ratekin was appointed Vice President and General Counsel of Huron in February 2011, and was named Executive Vice President in April 2011. She was appointed Corporate Secretary in December 2011. She had previously served as Huron’s Assistant Corporate Secretary since May 2009. Ms. Ratekin has been employed in Huron’s legal department since January 2005, and previously served as Deputy General Counsel. Prior to joining Huron, Ms. Ratekin was a partner in the Corporate Department of McGuireWoods LLP. Previously, she spent 17 years in the legal department of Deutsche Investment Management Americas Inc., formerly known as Zurich Scudder Investments, Inc. and Kemper Financial Services, Inc., where she was a Director and Team Leader of the Corporate and Investments Team. Before that, Ms. Ratekin was a litigator at Jenner & Block. She is a member of the American Bar Association, the Chicago Bar Association and the Association of Corporate Counsel. She received a B.A. in English and a J.D. from the University of Iowa.

Director Independence

Our Corporate Governance Guidelines require that the board of directors make an annual determination regarding the independence of each of our directors. The board of directors has determined that each of Messrs. Edwards, Lockhart, Massaro, McCartney and Moody and Ms. Zumwalt is “independent” as defined in the applicable listing standards of The NASDAQ Stock Market, Inc. (“NASDAQ”). In making its determination, the board of directors considered the standards of independence set forth in the NASDAQ Corporate Governance Listing Standards and all relevant facts and circumstances to ascertain whether there was any relationship between a director and the Company that, in the opinion of the board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of the director or any material relationship with the Company (either directly, or as a partner, stockholder or officer of an organization that has a relationship with the Company). In determining that Ms. Zumwalt is independent, the board of directors conducted a thorough review of payments made by Stanford University, which employs Ms. Zumwalt, to the Company for consulting services provided by the Company. After taking into consideration that Stanford University engagements comprised under 0.25% of Huron’s revenues for the year 2015, under 0.20% for the years 2014 and 2013, and under 0.50% for the years 2012 and 2011, the board of directors determined that this relationship would not interfere with Ms. Zumwalt’s exercise of independent judgment in carrying out her responsibilities as a director.

Board Leadership Structure and Risk Oversight

Board Leadership. Huron formally separated the roles of chairman of the board and chief executive officer in 2010. Our Non-executive Chairman is John McCartney and our Chief Executive Officer is James H. Roth. As Non-executive Chairman, Mr. McCartney, in consultation with Mr. Roth, develops the agendas for board meetings, determines the appropriate scheduling for board meetings, assesses the quality, quantity and timeliness of information provided from management to the board, assists the Nominating and Corporate Governance Committee in monitoring and implementing our Corporate Governance Guidelines and otherwise takes steps to ensure that the board is acting in the long-term best interests of the Company. Mr. McCartney also chairs executive sessions of the board. In addition, George E. Massaro serves as Vice Chairman.

The board has determined that our current board leadership structure is appropriate for the Company, as it believes the separation of powers is beneficial for our organization.

Risk Oversight. One of the board’s responsibilities is to review the adequacy of the Company’s systems for compliance with all applicable laws and regulations for safeguarding the Company’s assets and for managing the major risks it faces. The board executes its responsibility for risk management directly and through its committees.

In 2015, Huron formed the Enterprise Risk Management Committee, comprised of certain members of senior management in the Company. The purpose of the Enterprise Risk Management Committee is to provide a collaborative, ongoing assessment of the material enterprise risks facing the Company. The Enterprise Risk Management Committee oversees a process to anticipate, identify, prioritize, and manage material risks to the Company. Enterprise risk includes any strategic, operational, financial and compliance risks that may materially affect the Company’s ability to achieve its business objectives.

The board committees oversee risk matters associated with their respective areas of responsibility. For example, in addition to receiving reports from PricewaterhouseCoopers LLP (“PwC”), Huron’s independent registered public accounting firm, regarding significant accounting and financial reporting developments, our internal control over financial reporting and other matters, the Audit Committee receives reports from:Governance Committee in monitoring and implementing our Corporate Governance Guidelines and otherwise takes steps to ensure that the board is acting in the long-term best interests of the Company. Mr. McCartney also chairs executive sessions of the board. In addition, George E. Massaro serves as Vice Chairman.

The board has determined that our current board leadership structure is appropriate for the Company, as it believes the separation of powers is beneficial for our organization. RISK OVERSIGHT One of the board’s responsibilities is to review the adequacy of the Company’s systems for compliance with all applicable laws and regulations, for safeguarding the Company’s assets and for managing the major risks it faces. The board executes its responsibility for risk management directly and through its committees in a variety of ways, including the following: The General Counsel on legal developments;

Huron’s internal auditors on internal controls and financial compliance control matters;

The Chief Compliance Officer on whistleblower hotline and compliance related issues; and

The Enterprise Risk Management Committee on the group’s activities and the processes and controls in place to manage Huron’s material business risks.

The full board regularly considers potential business risks facing the Company, including those surrounding such issues as:

International compliance;

In 2015, we reviewed our material compensation policies and practices and reported to the Compensation Committee that these policies and practices are considered not to entail risks reasonably likely to have a material adverse effect on the Company. The Chief Compliance Officer, the CFO, the General Counsel, the Corporate Vice President, Human Resources and the Director

| | | Board of Compensation reviewed the plan elements, potential risks and various controls in place with respect to Huron’s executive, managing director, employee and business developer compensation plans. After reviewing the findings made by this group, the Compensation Committee agreed with the assessment that the compensation policies and practices are considered not to entail risks reasonably likely to have a material adverse effect on the Company. Board Meetings and Committees

The board of directors conducts its business through meetings of the full board, actions taken by written consent in lieu of meetings, and by the actions of its committees. During 2015, the board of directors held 11 meetings.

During 2015, each board member attended at least 75% of the aggregate number of board meetings and meetings of all the committees on which the director served. Although the Company does not have a formal policy regarding director attendance at our annual meetings, we encourage directors to attend. All directors attended the 2015 Annual Meeting of Stockholders.

The board of directors operates in part through its three committees: Audit, Compensation, and Nominating and Corporate Governance. All committee members are “independent” as defined in the applicable listing standards of NASDAQ. In addition, all Compensation Committee members are “non-employee directors” within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934 (the “1934 Act”) and “outside directors” within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), and all Audit Committee members meet the criteria for independence set forth in SEC Rule 10A-3(b)(1). A detailed discussion of each committee’s mission, composition and responsibilities is contained within the committee charters available in the Investor Relations section of the Company’s web site at www.huronconsultinggroup.com.

Audit Committee. The Audit Committee responsibilities include overseeing our accounting and financial reporting processes and overseeing the audits of our financial statements and internal control over financial reporting. The Audit Committee is also responsible for the appointment, compensation, retention, oversight and evaluation of the work of any registered public accounting firm engaged for the purpose of preparing or issuing an audit report or performing other services for us. Approval of audit and permitted non-audit services and applicable fees is made by the Audit Committee. The Audit Committee met eight times in 2015. The members of the Audit Committee are Messrs. Lockhart (Chairman), McCartney and Moody. The board of directors has determined that each Audit Committee member has sufficient knowledge in financial and auditing matters to serve on the Audit Committee. The board of directors has also determined that each of Messrs. Lockhart, McCartney and Moody is an “audit committee financial expert,” as defined by the applicable securities regulations, and that each member of the Audit Committee satisfies the applicable NASDAQ listing standards for audit committee membership.

The Report of the Audit Committee for the fiscal year ended December 31, 2015 appears below under the caption “PROPOSAL 3—RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM—Report of the Audit Committee.”

Compensation Committee. Pursuant to its charter, the Compensation Committee responsibilities include overseeing our compensation and benefit plans, including all compensation arrangements for executive officers and directors, each of which the Compensation Committee reviews annually and makes changes as it deems appropriate. The Compensation Committee met seven times in 2015. The members of the Compensation Committee are Ms. Zumwalt (Chair), Mr. Lockhart and Mr. Moody.

Management assists the Compensation Committee in the performance of its duties as described in more detail below under “EXECUTIVE COMPENSATION—Compensation Discussion and Analysis—Role of Management.” In addition, during 2015, the CEO participated in all of the Compensation Committee’s meetings and in all of the executive sessions, except for those in which the Compensation Committee considered the CEO’s performance, compensation and incentives. The committee extended the engagement of Semler Brossy Consulting Group, LLC as its outside compensation advisor to assist the committee in the execution of its charter. The support provided by the advisor is described in more detail below under “EXECUTIVE COMPENSATION—Compensation Discussion and Analysis—Role of Compensation Advisor.” The Report of the Compensation Committee on Executive Compensation appears below under the caption “EXECUTIVE COMPENSATION—Compensation Committee Report.”

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee responsibilities include identifying and recommending to the board of directors appropriate director nominee candidates and providing oversight with respect to corporate governance matters. The Nominating and Corporate Governance Committee met five times in 2015. The members of the Nominating and Corporate Governance Committee are Mr. Edwards (Chairman), Mr. Massaro and Ms. Zumwalt.

Directors may be nominated by the board of directors or by stockholders in accordance with the bylaws of the Company. The Nominating and Corporate Governance Committee will review all candidates for nomination to the board of directors, including those proposed by stockholders as provided below. The Nominating and Corporate Governance Committee reviews the person’s judgment, experience, independence, understanding of the Company’s business or other related industries, and such other factors as the Nominating and Corporate Governance Committee determines are relevant in light of the needs of the board of directors and the Company. The board of directors believes that its nominees should reflect over time a diversity of experience, gender, race, ethnicity and age, although it follows no strict criteria when making decisions. The Nominating and Corporate Governance Committee selects qualified candidates and reviews its recommendations with the board of directors, which will decide whether to invite the candidate to be a nominee for election to the board of directors. If the Nominating and Corporate Governance Committee receives a nominee recommendation in accordance with the rules of the SEC from a stockholder or group of stockholders that has beneficially owned more than 5% of the Company’s voting common stock for at least one year as of the date of the recommendation, the name of the candidate, the name(s) of the stockholder(s) who recommended the candidate, and whether the Nominating and Corporate Governance Committee chose to nominate the candidate will be disclosed in the proxy statement, if the consent of both the stockholder and the candidate has been received.

For a stockholder to submit a candidate for consideration by the Nominating and Corporate Governance Committee, a stockholder must notify the Company’s Corporate Secretary. In addition, the Company’s bylaws permit stockholders to nominate directors at a stockholders’ meeting. To make a director nomination at the annual meeting, a stockholder must notify the Company’s Corporate Secretary within the time periods specified under “SUBMISSION OF STOCKHOLDER PROPOSALS” below. Notices should be sent to: Corporate Secretary, Huron Consulting Group Inc., 550 West Van Buren Street, 17th Floor, Chicago, Illinois 60607, or corporatesecretary@huronconsultinggroup.com. In either case, the notice must meet all of the requirements contained in the bylaws.

Director Resignation Policy

The Company’s Corporate Governance Guidelines provide that in an uncontested election, any nominee for director who receives a greater number of votes “withheld” from his or her election than “for” his or her election shall promptly tender his or her resignation to the board of directors following certification of the election results, subject to acceptance by the board of directors. For purposes of this policy, (i) an “uncontested” election is one in which the number of persons properly nominated for election as directors as of the date that is ten (10) days before the record date for determining stockholders entitled to notice of or to vote at such meeting is not greater than the number of directors to be elected, and (ii) broker non-votes will not be counted as either votes “withheld” from or “for” such person’s election.

The Nominating and Corporate Governance Committee shall make a recommendation to the board of directors as to whether to accept or reject the tendered resignation, or whether other action should be taken. The board of directors shall determine whether to accept or reject the tendered resignation, or whether other action should be taken, in its sole discretion, and publicly disclose its decision regarding the tendered resignation within ninety (90) days from the date of the certification of the election results. The Nominating and Corporate Governance Committee in making its recommendation and the board of directors in making its decision may each consider any factors or other information that they consider appropriate and relevant.

If any director’s resignation is not accepted by the board of directors, such director shall continue to serve until such director’s successor is duly elected and qualified, or until such director’s earlier death, resignation, retirement, disqualification or removal. If a director’s resignation is accepted by the board of directors pursuant to this policy, then the board of directors, in its sole discretion, may fill any resulting vacancy pursuant to the provisions of Section 2 of Article III of the bylaws of the Company or may decrease the size of the board of directors pursuant to Section 1 of Article III of the bylaws of the Company.

Stockholder Communications Policy

| | • Regularly considers potential business risks facing the Company, including those surrounding security and privacy, revenue recognition, quality assurance, strategic planning, employee retention, international compliance, business continuity, merger integration and market shifts • Maintains oversight of key governance programs relating to insider trading, business conduct and ethics, export controls and other critical issues | Audit Committee | | • Meets with and reviews reports from independent registered public accounting firm and internal auditors • Receives regular reports from the General Counsel on legal developments • Examines issues presented by the Chief Compliance Officer on whistleblower hotline and corporate compliance-related matters • Considers reports of the Enterprise Risk Management Committee on strategic, operational, financial and compliance risks that may materially affect the Company’s ability to achieve its business objectives • Evaluates controls in place to address Huron’s global FCPA risks | Compensation Committee | | • Annually reviews a risk assessment of all Huron compensation plans • Reviews the design and goals of compensation programs in the context of potential risks to the Company • Reviews and evaluates compensation arrangements to assess the potential for undue risk taking | | Nominating and Corporate Governance Committee | | • Leads an annual self-assessment to ensure the board and its committees are properly fulfilling their roles • Ensures board candidates possess the appropriate experience and expertise required to effectively serve on Huron’s board • Annually reviews Huron’s corporate governance guidelines to confirm they reflect best practices |

BOARD MEETINGSAND COMMITTEES The board of directors conducts its business through meetings of the full board, actions taken by written consent in lieu of meetings, and by the actions of its committees. During 2017, the board of directors held 12 meetings. During 2017, each board member attended at least 75% of the aggregate number of board meetings and meetings of all the committees on which the director served. Although the Company does not have a formal policy regarding director attendance at our annual meetings, we encourage directors to attend. Six directors attended the 2017 Annual Meeting of Stockholders. The board of directors operates in part through its three committees: Audit, Compensation, and Nominating and Corporate Governance. All committee members are “independent” as defined in the applicable listing standards of NASDAQ. In addition, all Compensation Committee members are“non-employee directors” within the meaning of Rule16b-3 under the Securities Exchange Act of 1934 (the “1934 Act”) and “outside directors” within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), and all Audit Committee members meet the criteria for independence set forth in SEC Rule10A-3(b)(1). A detailed discussion of each committee’s mission, composition and responsibilities is contained within the committee charters available in the Investor Relations section of the Company’s web site atwww.huronconsultinggroup.com. Audit Committee The Audit Committee responsibilities include overseeing our accounting and financial reporting processes, the audits of our financial statements, and the Company’s internal controls over financial reporting. The Audit Committee is also responsible for the appointment, compensation, retention, oversight and evaluation of the work of any registered public accounting firm engaged for the purpose of preparing or issuing an audit report or performing other services for us. As such, the Audit Committee approves audit and permittednon-audit services and applicable fees. The Audit Committee met ten times in 2017. The members of the Audit Committee are Messrs. Lockhart (Chair), McCartney and Moody. The board of directors has determined that each Audit Committee member has sufficient knowledge in financial and auditing matters to serve on the Audit Committee. The board of directors has also determined that each of Messrs. Lockhart, McCartney and Moody is an “audit committee financial expert,” as defined by the applicable securities regulations, and that each member of the Audit Committee satisfies the applicable NASDAQ listing standards for audit committee membership. The Report of the Audit Committee for the fiscal year ended December 31, 2017 appears below under the caption “PROPOSAL 3—RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM—Report of the Audit Committee.” Compensation Committee Pursuant to its charter, the Compensation Committee responsibilities include overseeing our compensation and benefit plans, including all compensation arrangements for executive officers and directors, each of which the Compensation Committee reviews annually and makes changes as it deems appropriate. The Compensation Committee met seven times in 2017. The members of the Compensation Committee are Ms. Zumwalt (Chair), Mr. Lockhart and Mr. Moody. Management assists the Compensation Committee in the performance of its duties as described in more detail below under “EXECUTIVE COMPENSATION—Compensation Discussion and Analysis—Role of Management.” In addition, during 2017, the CEO participated in all of the Compensation Committee’s meetings and in all of the executive sessions, except for those in which the Compensation Committee considered the CEO’s performance, compensation and incentives. The Committee engaged the firm of Pay Governance LLC as its outside compensation advisor to assist the Committee in the execution of its charter. The support provided by the advisor is described in more detail below under “EXECUTIVE COMPENSATION—Compensation Discussion and Analysis—Role of Compensation Advisor.” The Report of the Compensation Committee on Executive Compensation appears below under the caption “EXECUTIVE COMPENSATION—Compensation Committee Report.” Nominating and Corporate Governance Committee The Nominating and Corporate Governance Committee responsibilities include identifying and recommending to the board of directors appropriate director nominee candidates and providing oversight with respect to corporate governance matters. The Nominating and Corporate Governance Committee met four times in 2017. The members of the Nominating and Corporate Governance Committee are Mr. Edwards (Chair), Mr. Massaro and Ms. Zumwalt. Directors may be nominated by the board of directors or by stockholders in accordance with the bylaws of the Company. The Nominating and Corporate Governance Committee will review all candidates for nomination to the board of directors, including those proposed by stockholders as provided below. The Nominating and Corporate Governance Committee reviews the person’s judgment, experience, independence, understanding of the Company’s business or other related industries, and such other factors as the Nominating and Corporate Governance Committee determines are relevant in light of the needs of the board of directors and the Company. The board of directors believes that its nominees should reflect over time a diversity of experience, gender, race, ethnicity and age, although it follows no strict criteria when making decisions. The Nominating and Corporate Governance Committee selects qualified candidates and reviews its recommendations with the board of directors, which will decide whether to invite the candidate to be a nominee for election to the board of directors. If the Nominating and Corporate Governance Committee receives a nominee recommendation in accordance with the rules of the SEC from a stockholder or group of stockholders that has beneficially owned more than 5% of the Company’s voting common stock for at least one year as of the date of the recommendation, the name of the candidate, the name(s) of the stockholder(s) who recommended the candidate, and whether the Nominating and Corporate Governance Committee chose to nominate the candidate will be disclosed in the proxy statement, if the consent of both the stockholder and the candidate has been received. For a stockholder to submit a candidate for consideration by the Nominating and Corporate Governance Committee, a stockholder must notify the Company’s Corporate Secretary. In addition, the Company’s bylaws permit stockholders to nominate directors at a stockholders’ meeting. To make a director nomination at the annual meeting, a stockholder must notify the Company’s Corporate Secretary within the time periods specified under “SUBMISSION OF STOCKHOLDER PROPOSALS” below. Notices should be sent to: Corporate Secretary, Huron Consulting Group Inc., 550 West Van Buren Street, 17th Floor, Chicago, Illinois 60607, orcorporatesecretary@huronconsultinggroup.com. In either case, the notice must meet all of the requirements contained in the bylaws. DIRECTOR RESIGNATION POLICY The Company’s Corporate Governance Guidelines provide that in an uncontested election, any nominee for director who receives a greater number of votes “withheld” from his or her election than “for” his or her election shall promptly tender his or her resignation to the board of directors following certification of the election results, subject to acceptance by the board of directors. For purposes of this policy, (i) an “uncontested” election is one in which the number of persons properly nominated for election as directors as of the date that is ten (10) days before the record date for determining stockholders entitled to notice of or to vote at such meeting is not greater than the number of directors to be elected, and (ii) brokernon-votes will not be counted as either votes “withheld” from or “for” such person’s election. The Nominating and Corporate Governance Committee shall make a recommendation to the board of directors as to whether to accept or reject the tendered resignation, or whether other action should be taken. The board of directors shall determine whether to accept or reject the tendered resignation, or whether other action should be taken, in its sole discretion, and publicly disclose its decision regarding the tendered resignation within ninety (90) days from the date of the certification of the election results. The Nominating and Corporate Governance Committee in making its recommendation and the board of directors in making its decision may each consider any factors or other information that they consider appropriate and relevant. If any director’s resignation is not accepted by the board of directors, such director shall continue to serve until such director’s successor is duly elected and qualified, or until such director’s earlier death, resignation, retirement, disqualification or removal. If a director’s resignation is accepted by the board of directors pursuant to this policy, then the board of directors, in its sole discretion, may fill any resulting vacancy pursuant to the provisions of Section 2 of Article III of the bylaws of the Company or may decrease the size of the board of directors pursuant to Section 1 of Article III of the bylaws of the Company. STOCKHOLDER COMMUNICATIONS POLICY The Company’s board of directors has established a process for stockholders to send communications to the board of directors. Stockholders may communicate with any member of the board of directors, including the chairperson of any committee, an entire committee or the independent directors or all directors as a group, by sending written communications to: Corporate Secretary Huron Consulting Group Inc. 550 West Van Buren Street 17th Floor Chicago, Illinois 60607 E-mail messages should be sent tocorporatesecretary@huronconsultinggroup.com. A stockholder must include his or her name and address in any such written ore-mail communication. The communication must indicate that the sender is a Company stockholder. Each communication intended for the board of directors and received by the Corporate Secretary that is related to the operation of the Company and is not otherwise commercial in nature will be forwarded to the specified party following its clearance through normal security procedures. If the communication is mailed as personal, it will not be opened, but rather will be forwarded unopened to the intended recipient. Diversity of Board Skills and ExperienceDIVERSITYOF BOARD SKILLSAND EXPERIENCE

Huron does not have a formal policy on board member diversity. The Nominating and Corporate Governance Committee, in discussing board composition, has focused on diversity of experience in relation to the development of the business. The Nominating and Corporate Governance Committee seeks candidates from regions where Huron offices are located, with prior management experience and experience on public company boards and in relevant industries. Compensation of DirectorsCOMPENSATIONOF DIRECTORS

The Huronnon-employee director compensation program is designed to enhance our ability to attract and retain highly qualified directors and to align their interests with the long-term interests of our stockholders. The program consists of both a cash component, designed to compensate independent directors for their service on the board and its committees, and an equity component, designed to align the interests of independent directors and stockholders. Mr. Roth receives no compensation for his service on the board. The 2015Effective as of July 1, 2016, the director compensation program hadis comprised of the following elements:

•

• Non-executive Chairman - $235,000

• Vice Chairman - $85,000

• Other independent directors - $60,000

•

Board and committee meeting fee of $1,000 per meeting (The Chairman does not receive board or committee meeting fees.) •

Annual committee chairperson retainer of: • Compensation - $7,500$15,000

• Nominating and Corporate Governance - $7,500$10,000

Annual restricted stock grant of $170,000 (granted on the date of the Company’s annual meeting and priced based upon the closing stock price on the date immediately preceding the annual meeting)of grant) which vests ratably over 12 quarters. If a new independent director joins the board after the Company’s annual meeting, the award is prorated as follows: • If the new director joins within six months of the Company’s annual meeting, the new director will receive half of the annual grant.

• If the new director joins over six months after the Company’s annual meeting, no grant will be made.

Stock ownership requirement – independent directors are expected to own Huron stock equal to the lesser of three times the annual cash retainer (currently $180,000) or 9,000 shares. A new independentnon-employee director will receive an initial restricted stock grant equal to $200,000, which will vest ratably over 12 quarters. All directors are reimbursed forout-of-pocket expenses for attending board and committee meetings. Directors are eligible to participate in our deferred compensation plan, which is described under the caption “EXECUTIVE COMPENSATION—20152017 Nonqualified Deferred Compensation.” One director has participated since 2013, and a second director elected to participate beginning in 2015. Director Compensation TableDIRECTOR COMPENSATION TABLE

The following table summarizes the fees paid and the aggregate grant date fair value of shares granted to each of thenon-employee directors in 2015.2017. Directors who are also officers or employees of the Company receive no compensation for duties performed as a director. | | | | | | | | | Name | | Fees Earned or

Paid in Cash ($) | | Stock

Awards($)(1) | | Change in Pension

Value and

Nonqualified

Deferred

Compensation

Earnings ($)(2) | | Total ($) | DuBose Ausley (3) | | 48,000 | | — | | — | | 48,000 | James D. Edwards (3) | | 82,500 | | 169,978 | | — | | 252,478 | H. Eugene Lockhart (3) | | 93,000 | | 169,978 | | — | | 262,978 | George E. Massaro (3) | | 100,000 | | 169,978 | | — | | 269,978 | John McCartney (3) | | 235,000 | | 169,978 | | 0 | | 404,978 | John S. Moody (3) | | 88,500 | | 169,978 | | — | | 258,478 | Debra Zumwalt (4) | | 76,000 | | 169,978 | | 0 | | 245,978 |

| | | | | | | | | | | | | | | | | | Name (5) | | Fees Earned or

Paid in Cash ($) | | | Stock

Awards ($)(1) | | | Change in Pension

Value and Nonqualified

Compensation

Earnings ($)(2) | | | Total ($) | | James D. Edwards (3) | | | 85,000 | | | | 169,990 | | | | — | | | | 254,990 | | H. Eugene Lockhart (3) | | | 101,000 | | | | 169,990 | | | | — | | | | 270,990 | | George E. Massaro (3) | | | 101,000 | | | | 169,990 | | | | — | | | | 270,990 | | John McCartney (3)(4) | | | 235,000 | | | | 169,990 | | | | 112,816 | | | | 517,806 | | John S. Moody (3) | | | 89,000 | | | | 169,990 | | | | — | | | | 258,990 | | Debra Zumwalt (3) | | | 96,000 | | | | 169,990 | | | | 19,872 | | | | 285,862 | |

| (1) | This column represents the aggregate grant date fair value of shares granted to our directors in 2015.2017. Grant date fair value is based on the closing price of Huron stock on the last trading day prior to the grant date.of grant. Each of these grants vests ratably over the 12 calendar quarters following the grant. |

| (2) | The amount in this column represents investment gains in the deferred compensation plan. Huron does not offer a pension plan. The amount shown above represents that portion of the account earnings for 20152017 that exceeded the SEC benchmark “market” rate equal to 120% of the long-term applicable federal rate (based on the average rate for 20152017 of 3.05%2.72%). For 2015,2017, the actual earnings for Mr. McCartney and Ms. Zumwalt were -$1,798$134,348 and -$207,$28,141, respectively. These amounts were less than the 3.05% market rate. |

| (3) | Upon his retirement from the board in May 2015, the vesting of Mr. Ausley’s restricted common stock was accelerated. At December 31, 2015,2017, each of Messrs. Edwards, Lockhart, Massaro, McCartney, Moody and MoodyMs. Zumwalt held 4,2705,158 shares of restricted common stock.

|

| (4) | At December 31, 2015, Ms. Zumwalt held 4,986 sharesMr. McCartney has access to office space at the Company’s principal business offices in Chicago. The Company does not incur any incremental costs in connection with the provision of restricted common stock.this office space.

|

| (5) | Hugh E. Sawyer was appointed to the board in February 2018. He had previously served as a managing director at Huron from January 2010 until May 2017, where he led the Operational Improvement Service Line for Huron’s Business Advisory practice. All compensation paid to Mr. Sawyer in 2017, which consisted of base salary paid through his departure and payment of his 2016 bonus, was in connection with his managing director role. |

Section 16(a) Beneficial Ownership Reporting ComplianceSECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Pursuant to Section 16(a) of the 1934 Act, the Company’s directors, executive officers and persons who beneficially own 10% or more of our common stock (the “Section 16 Reporting Persons”) are required to report their initial ownership of common stock and subsequent changes in that ownership to the SEC. Section 16 Reporting Persons are required to furnish the Company with copies of all Section 16(a) forms that they file. Based upon our review of forms filed by the Section 16 Reporting Persons pursuant to the 1934 Act, we have not identified any late filings in 2015.2017. Stock Ownership of Certain Beneficial Owners and ManagementSTOCK OWNERSHIPOF CERTAIN BENEFICIAL OWNERSAND MANAGEMENT

The following table sets forth, as of the Record Date, certain information regarding the beneficial ownership of our common stock by: each person known by us to beneficially own 5% or more of our common stock; each of our named executivesexecutive officers; each member of our board of directors; and all directors and executive officers as a group. Beneficial ownership is determined according to the rules of the Securities and Exchange Commission (the “SEC”) and generally means that a person has beneficial ownership of a security if he or she possesses sole or shared voting or investment power of that security and includes options that are currently exercisable or exercisable within 60 days. Each director, officer or 5% or more stockholder, as the case may be, has furnished us with information with respect to beneficial ownership. Except as otherwise indicated, beneficial owners of common stock listed below, based on the information each of them has given to us, have sole investment and voting power with respect to their shares, except where community property laws may apply. | | | | | | | | | | | | Beneficial Ownership | | Name of beneficial owner (1) | | Shares | | | % | | Beneficial owners of 5% or more: | | | | | | | | | Wellington Management Group LLP (2) | | | 2,316,070 | | | | 10.69 | | The Vanguard Group, Inc. (3) | | | 1,548,521 | | | | 6.75 | | FMR LLC (4) | | | 1,499,735 | | | | 6.54 | | TimesSquare Capital Management, LLC (5) | | | 1,425,477 | | | �� | 6.20 | | BlackRock, Inc. (6) | | | 1,242,933 | | | | 5.40 | | Directors and Executive Officers: | | | | | | | | | James D. Edwards (7) | | | 18,983 | | | | * | | C. Mark Hussey (8) | | | 41,866 | | | | * | | H. Eugene Lockhart (9) | | | 23,193 | | | | * | | George E. Massaro (10) | | | 17,172 | | | | * | | John McCartney (11) | | | 51,325 | | | | * | | John S. Moody (12) | | | 18,782 | | | | * | | Diane E. Ratekin (13) | | | 37,083 | | | | * | | James H. Roth (14) | | | 349,672 | | | | 1.61 | | Debra Zumwalt (15) | | | 6,898 | | | | * | | All directors and executive officers as a group (9 persons) (16) | | | 564,974 | | | | 2.60 | |

| | | | | | | | | | | | Beneficial Ownership | | | Name of beneficial owner (1) | | Shares | | | % | | Beneficial owners of 5% or more: | | | | | | | | | Wellington Management Group LLP (2) | | | 3,102,878 | | | | 14.02 | | Van Berkom & Associates Inc. (3) | | | 1,927,915 | | | | 8.71 | | The Vanguard Group, Inc. (4) | | | 1,774,571 | | | | 8.01 | | BlackRock, Inc. (5) | | | 1,444,220 | | | | 6.50 | | Dimensional Fund Advisors LP (6) | | | 1,393,051 | | | | 6.30 | | Boston Partners (7) | | | 1,286,433 | | | | 5.81 | | FMR LLC (8) | | | 1,173,291 | | | | 5.30 | | Directors and Executive Officers: | | | | | | | | | James D. Edwards (9) | | | 21,524 | | | | * | | C. Mark Hussey (10) | | | 98,945 | | | | * | | John D. Kelly (11) | | | 9,386 | | | | | | H. Eugene Lockhart (12) | | | 22,160 | | | | * | | George E. Massaro (13) | | | 17,744 | | | | * | | John McCartney (14) | | | 57,155 | | | | * | | John S. Moody (15) | | | 19,653 | | | | * | | Diane E. Ratekin (16) | | | 39,957 | | | | * | | James H. Roth (17) | | | 380,291 | | | | 1.69 | | Hugh E. Sawyer (18) | | | 13,095 | | | | * | | Debra Zumwalt (19) | | | 12,283 | | | | * | | All directors and executive officers as a group (11 persons) (20) | | | 692,193 | | | | 3.08 | |

| * | Indicates less than 1% ownership. |

| (1) | The principal address for each of the stockholders, other than Wellington Management Group LLP, Van Berkom & Associates Inc., The Vanguard Group, Inc., FMR LLC, TimesSquare Capital Management, LLC, and BlackRock, Inc., Dimensional Fund Advisors LP, Boston Partners, and FMR LLC, listed below, is c/o Huron Consulting Group Inc., 550 West Van Buren Street, Chicago, Illinois 60607. |

| (2) | The principal address of Wellington Management Group LLP is 280 Congress Street, Boston, Massachusetts 02210. The shares are owned by Wellington Management Group LLP and the following subsidiaries of Wellington Management Group LLP: Wellington Group Holdings LLP, Wellington Investment Advisors Holdings LLP and Wellington Management Company LLP. Information regarding beneficial ownership of our common stock by Wellington Management Group LLP is included herein in reliance on a Schedule 13G/A filed with the SEC on March 10, 2016.February 8, 2018. |

| (3) | The principal address of Van Berkom & Associates Inc. is 1130 Sherbrooke Street West, Suite 1005, Montreal, Quebec H3A 2MB. Information regarding beneficial ownership of our common stock by Van Berkom & Associates Inc. is included herein in reliance on a Schedule 13G filed with the SEC on February 13, 2018. |

| (4) | The principal address of The Vanguard Group, Inc. is 100 Vanguard Boulevard, Malvern, Pennsylvania 19355. The shares are owned by The Vanguard Group, Inc. and the following subsidiaries of The Vanguard |

| Group, Inc.: Vanguard Fiduciary Trust Company and Vanguard Investments Australia, Ltd. Information regarding beneficial ownership of our common stock by The Vanguard Group, Inc. is included herein in reliance on a Schedule 13G/A filed with the SEC on February 11, 2016.9, 2018. |

(4)(5) | The principal address of BlackRock, Inc. is 55 East 52nd Street, New York, New York 10055. The shares are owned by the following subsidiaries of BlackRock, Inc.: BlackRock (Netherlands) B.V., BlackRock Advisors (UK) Limited, BlackRock Advisors, LLC, BlackRock Asset Management Canada Limited, BlackRock Asset Management Ireland Limited, BlackRock Asset Management Schweiz AG, BlackRock Financial Management, Inc., BlackRock Fund Advisors, BlackRock Institutional Trust Company, N.A., BlackRock Investment Management (Australia) Limited, BlackRock Investment Management (UK) Ltd. and BlackRock Investment Management, LLC. Information regarding beneficial ownership of our common stock by BlackRock, Inc. is included herein in reliance on a Schedule 13G/A filed with the SEC on January 25, 2018. |

| (6) | The principal address of Dimensional Fund Advisors LP is Building One, 6300 Bee Cave Road, Austin, Texas 78746. Information regarding beneficial ownership of our common stock by Dimensional Fund Advisors LP is included herein in reliance on a Schedule 13G/A filed with the SEC on February 9, 2018. |

| (7) | The principal address of Boston Partners is One Beacon Street, 30th Floor, Boston, Massachusetts 02108. Information regarding beneficial ownership of our common stock by Boston Partners is included herein in reliance on a Schedule 13G filed with the SEC on February 13, 2018. |

| (8) | The principal address of FMR LLC is 245 Summer Street, Boston, Massachusetts 02210. The shares are owned by FMR LLC and the following subsidiaries of FMR LLC: FIAM LLC, Fidelity (Canada) Asset Management ULC, Fidelity Institutional Asset Management Trust Company, FMR Co., Inc., and Strategic Advisers, Inc. Information regarding beneficial ownership of our common stock by FMR LLC is included herein in reliance on a Schedule 13G/A filed with the SEC on February 12, 2016.14, 2018. |

(5)(9) | The principal addressIncludes 4,355 shares of TimesSquare Capital Management, LLC is 7 Times Square, 42nd Floor, New York, New York 10036. Information regarding beneficial ownership of ourrestricted common stock by TimesSquare Capital Management, LLC is included herein in reliance on a Schedule 13G/A filed with the SEC on February 10, 2016.

|

(6) | The principal address of BlackRock, Inc. is 55 East 52nd Street, New York, New York 10055. The shares are owned by the following subsidiaries of BlackRock, Inc.: BlackRock Advisors, LLC, BlackRock Asset Management Canada Limited, BlackRock Asset Management Ireland Limited, BlackRock Asset Management Schweiz AG, BlackRock Fund Advisors, BlackRock Institutional Trust Company, N.A., BlackRock Investment Management (Australia) Limited, BlackRock Investment Management (UK) Ltd. and BlackRock Investment Management, LLC. Information regarding beneficial ownership of our common stock by BlackRock, Inc. is included herein in reliance on a Schedule 13G/A filed with the SEC on February 10, 2016.stock.

|

(7)(10) | Includes 3,484 shares of restricted common stock. |

(8) | Includes 13,71415,647 shares issuable upon exercise of options that are exercisable currently or within 60 days of the Record Date. Also includes 9,55556,459 shares of restricted common stock.

|

(9)(11) | Includes 3,4847,109 shares of restricted common stock. |

(10)(12) | Includes 3,4844,355 shares of restricted common stock. |

(11)(13) | Includes 3,4844,355 shares of restricted common stock. |

| (14) | Includes 4,355 shares of restricted common stock, as well as 1,259 shares held by a wholly-owned limited liability company of which Mr. McCartney is the sole owner. |

(12)(15) | Includes 3,4844,355 shares of restricted common stock. |

(13)(16) | Includes 11,4027,904 shares issuable upon exercise of options that are exercisable currently or within 60 days of the Record Date. Also includes 5,1928,775 shares of restricted common stock. |

(14)(17) | Includes 164,732160,746 shares issuable upon exercise of options that are exercisable currently or within 60 days of the Record Date. Also includes 22,37050,533 shares of restricted common stock, as well as 3,855 shares held by a family partnership.limited liability company. |

(15)(18) | Includes 4,3918,799 shares of restricted common stock. |

(16)(19) | Includes 4,355 shares of restricted common stock. |

| (20) | Includes an aggregate of 189,848184,297 shares issuable upon exercise of options held by members of the group that are exercisable currently or within 60 days of the Record Date. Also includes 58,928Date, as well as 157,805 shares of restricted common stock.stock held by the Directors and Executive Officers listed above. |

EXECUTIVE COMPENSATION Compensation Discussion and AnalysisCOMPENSATION DISCUSSIONAND ANALYSIS

The Compensation Discussion and Analysis provides information regarding the objectives and elements of our compensation program with respect to the compensation of persons who appear in the Summary Compensation Table (who we refer to collectively throughout this Proxy Statement as our “named executive officers” or “NEOs”). | | | SECTION 1 — EXECUTIVE SUMMARY | Huron is a global professional services firm focused on assisting clientscommitted to achieving sustainable results in partnership with their most complex business issues by delivering high-value, quality solutionsits clients. The company brings depth of expertise in strategy, technology, operations, advisory services and analytics to support their long-term strategic objectives. Huron specializes in serving clientsdrive lasting and measurable results in the healthcare, higher education, life sciences and commercial sectors as these organizations face significant transformational changesectors. Through focus, passion and regulatory or economic pressures in dynamic market environments. With its deep industry and technical expertise,collaboration, Huron provides advisory, consulting, technology,guidance to support organizations as they contend with the change transforming their industries and analytic solutions to deliver sustainable and measurable results.businesses. Named Executive Officers This past year,During 2017, Huron’s named executive officer team consisted of the following individuals:

• Mr. Roth, Chief Executive Officer, President and Director. • Mr. Hussey, Executive Vice President and Chief Operating Officer,Officer.1 •Mr. Kelly, Executive Vice President, Chief Financial Officer and Treasurer.1 • Ms. Ratekin, Executive Vice President, General Counsel and Corporate Secretary. Huron’s named executive officers are responsible for our Company-wide business operations and setting overall strategy of the organization. ConsultingPractice Leadership

Each of Huron’s operating segments is led by Practice Leadership and teams of client-facing managing directors. The Practice Leaders and client-facing managing directors for each business area are responsible for the financial results of their respective business area, including revenue and EBITDA growth, while ensuring delivery of superior services.solutions. These leaders have the critical talent and skills that make us unique and enable us to grow our business and compete in the marketplace. It is imperative to our core business strategy that we motivate and retain our current client-facing managing directors and obtain new talent through recruiting and developing our high potential employees so that they can progress to higher level leadership roles within the Company. | | Business Strategy | Business | | Compensation | Our business strategy is to be the premier professional services firm specializingtransformation partner to our clients. Through our integrated capabilities, we help organizations own their future in the healthcare, education, and life sciences markets while providing complementary financial advisory and technology services to these core vertical markets as well as the commercial sector.face of rapid change. To ensure the success of our strategy and our ability to deliver sustained value to our shareholders, Huron focuses on the following key drivers: • Specialize in enabling organizations to lead through transformational change by providing integrated offerings built on the strength of our industry knowledge. • Deliver high-value, quality client serviceservices to our clients to support their comprehensive needs, from strategy setting to implementation.execution. • Broaden and strengthen our capabilities to continue to best serve our clients while maintaining and growing our strong industry expertise. • Specialize in offering deep industry specific consulting expertise to our healthcare, education, and life sciences clients. • Attract, retain, and motivate top tier client-facing employees who have substantialwith diverse perspectives and experience levels, including subject matter and/or technical expertise.

• Supplement organic growth by successfully identifying, executing and successfully integrating acquisitions that expand or complement our current market offerings.offerings and deepen our industry expertise or broaden our capabilities to best serve our clients’ needs. • Optimize our corporate infrastructure to effectively scale and support the Company’s long-term growth plans, while enhancing EBITDA margins. |

| 1 | On January 3, 2017, Mr. John Kelly was promoted to the position of Executive Vice President and Chief Financial Officer (“CFO”). Formerly, Mr. Kelly had been Corporate Vice President and Chief Accounting Officer. With Mr. Kelly assuming the CFO role, Mr. Hussey has transitioned this role and has become Executive Vice President and Chief Operating Officer. Mr. Hussey also assumed the interim role of Healthcare Practice Leader. |

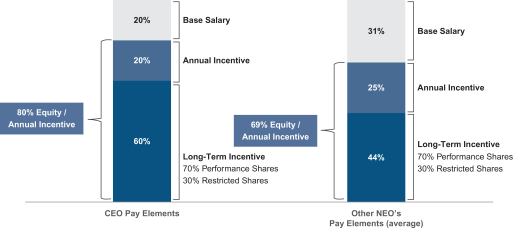

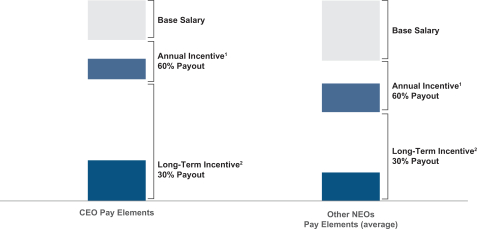

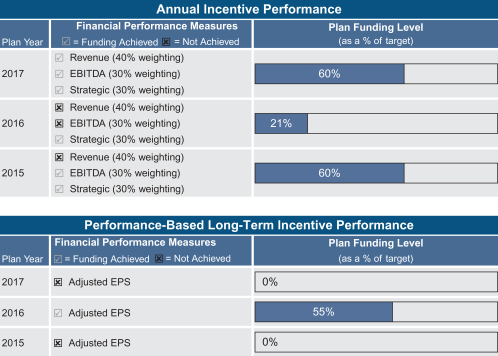

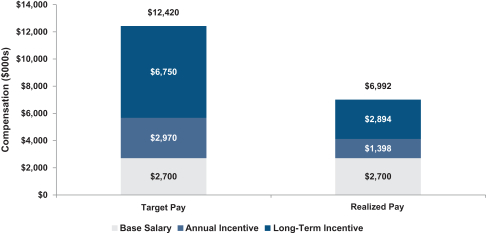

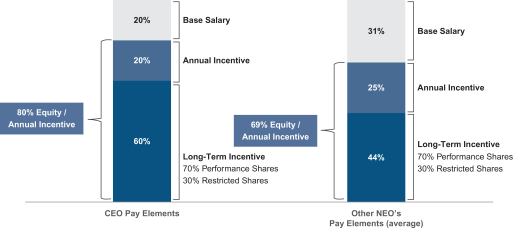

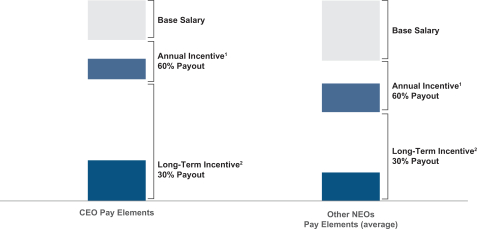

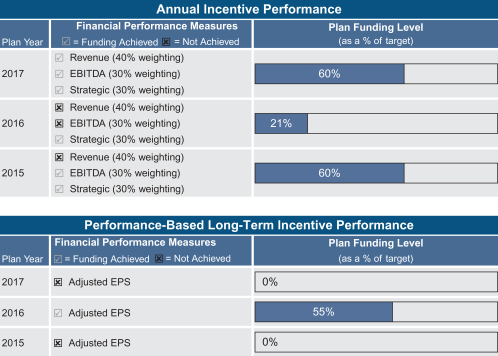

| | | | Compensation Strategy | Our compensation plan philosophy has three key elements: • Motivate and reward performance in the long-term best interests of shareholders. • Deliver competitive total compensation generally targeted at the median of the peer group(+/-15%). • Place a substantial portion of the compensation of our named executive officers at risk; actual payouts should vary based on the Company’s financial and operational performance. The performance measures directly link into our business strategy through revenue,net revenues, Adjusted EBITDA margin, and Adjusted Diluted EPS growth as well as fulfillment of strategic measures identified each year by the board of directors. As a result, weWe annually grant a sizeablesizable portion of equity to our managing directors (andirectors. An average of 83% of total equity granted in each of the last three years; by contrast, approximately 10%80% of total equity granted in the pastlast three years iswas awarded to NEOs).our managing directors with the balance awarded to NEOs, other employees and directors. As a professional services firm, we recognize that our managing directors are critical to developing and maintaining client relationships, generating revenue and todriving the overall success of Huron. We use stock as both a retention tool and an incentive to incentencourage behaviors that will benefit the shareholders as well asand the Company as a whole.Company. Approximately 50% of the annual bonus compensation of our Practice Leaders and client-facing managing directors consists of restricted stock that vests over four years.years, and is awarded based on prior year performance. We believe this element of our compensation aligns the interests of each of our individual practices with the Company as a whole and significantlyimportantly differentiates Huron’s compensation program from our competitors’ programs, because of the amount of equity provided below the NEO level.by aligning our managing directors with Huron’s long-term value creation.

|

1 | On February 25, 2016, Mr. Hussey transitioned the role of Treasurer to John D. Kelly, Huron’s Chief Accounting Officer.

|

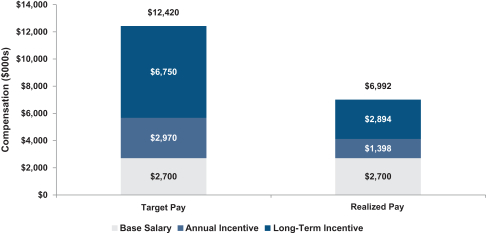

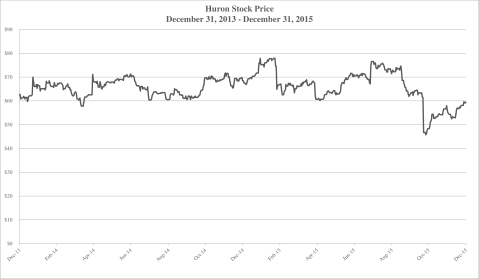

| Business Actions and Results | To understand our compensation decision making, it is important to understand the

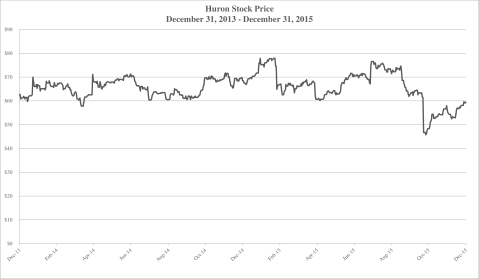

The Company’s financial strategic and other objectivestrategic performance during 2015. During 2015, we evaluated2017 determine the evolving strategic needsmajority of the Legal business and concluded that we would be challenged to provide the investments necessary to be responsive to the face of a changing market and to achieve the practice’s growth objectives. As a result, we determined that the practice would be better aligned with a new partner. We divested the Legal business and sold the practice to Consilio, Inc. on December 31, 2015. Going forward, we will maintain our strategic focus on the Company’s remaining core businesses of Healthcare, Education and Life Sciences, and Business Advisory. Due to the divestiture, the results of the Huron Legal segment have been reclassified as discontinued operations. To provide comparable historical results and a meaningful basis with which to evaluate the Company’s future prospects, all financial information throughout this Proxy Statement is presented on a continuing operations basis, unless otherwise noted.NEO’s compensation.

Business results were as follows2: We define success through

• Our 2017 financial results came in lower than we expected, driven by further softness in our Healthcare business. The decline in Healthcare was partially offset by growth in our Education and Business Advisory segments. • Net revenues were $732.6 million in 2017, compared to $726.3 million in the prior year. • Adjusted EBITDA decreased 19.3% to $104.6 million in 2017, or 14.3% of net revenues, compared to 17.9% in the prior year. • Adjusted diluted EPS was $2.15 in 2017, a number of measures, and in 2015 we had a mixed performance33.0% decrease from the prior year. • While we delivered results that were lower than our initial guidance, we undertookhave made significant progress in the operational turnaround of our Healthcare business positioning us to be more responsive to changing market conditions. Among other initiatives, we have enhanced the level of collaboration across all of our service lines. Our efforts have better equipped the Healthcare business to compete across a wider spectrum of engagement sizes and durations by developing more flexible delivery models.

• We also completed two significant strategic initiatives – the large acquisition of Studer Groupacquisitions in 2017. We acquired Innosight and Pope Woodhead in the healthcare segment,first quarter, strategically adding to our Business Advisory segment. We believe these acquisitions strengthen our strategy capabilities and the divestitureprovide us with a comprehensive set of the Legal business, that we believe position Huron for success in 2016. • Net revenues of $699.0 million, 11.4% higher than the prior year.

• Adjusted EBITDA increased 25.9%offerings to $139.3 million, or 19.9% of net revenues comparedserve our clients—from strategy setting to 17.6% in the prior year.

• Adjusted diluted EPS of $2.99, a 22.0% increase over the prior year.

• Completed threeexecution. These acquisitions that in the aggregatealso strengthen our international footprint to best serve our growing, global client base. These acquisitions contributed over $81almost $44 million in revenues during 2015.2017 and performed largely as planned.

• Reorganized corporate infrastructure to align with business expectation In 2017, we defined our new, five-year enterprise-level strategy, created a unified sense of purpose and to gain efficiencies, resulting in $11 million in identified cost reductions to lower SG&A expense. • Maintainedsecured the commitment of our employees through a strong balance sheet while funding more than $408 million in acquisitionsnew vision, mission, set of values and other investments, share repurchases and capital expenditures.

• Generated cash flow from operations of $164 million enabling the Company to reduce its leverage ratio, defined as total debt, net of cash, divided by Adjusted EBITDA to 2.1x as of December 31, 2015.

| Compensation Program Actions

| The Compensation Committee took several compensation actions beginning in 2014 to better align the compensation plan with our business strategy and shareholder interests.

• In 2014, added a three-year performance measurement period to performance shares to align multi-year performance and long-term compensation; 2015 marks the second year of the three-year performance measurement period.

• In 2014, replaced stock options with restricted share awards (RSAs) in the service-based equity portion of the Long-Term Incentive Planmodified brand positioning all designed to align with our peer group andstrategy.